ESG

For the ORLEN Group, ESG is an important part of strategic management. ESG considerations are integrated into the ORLEN Group's business strategy to enhance the Group's financial performance and build long-term value for all stakeholders.

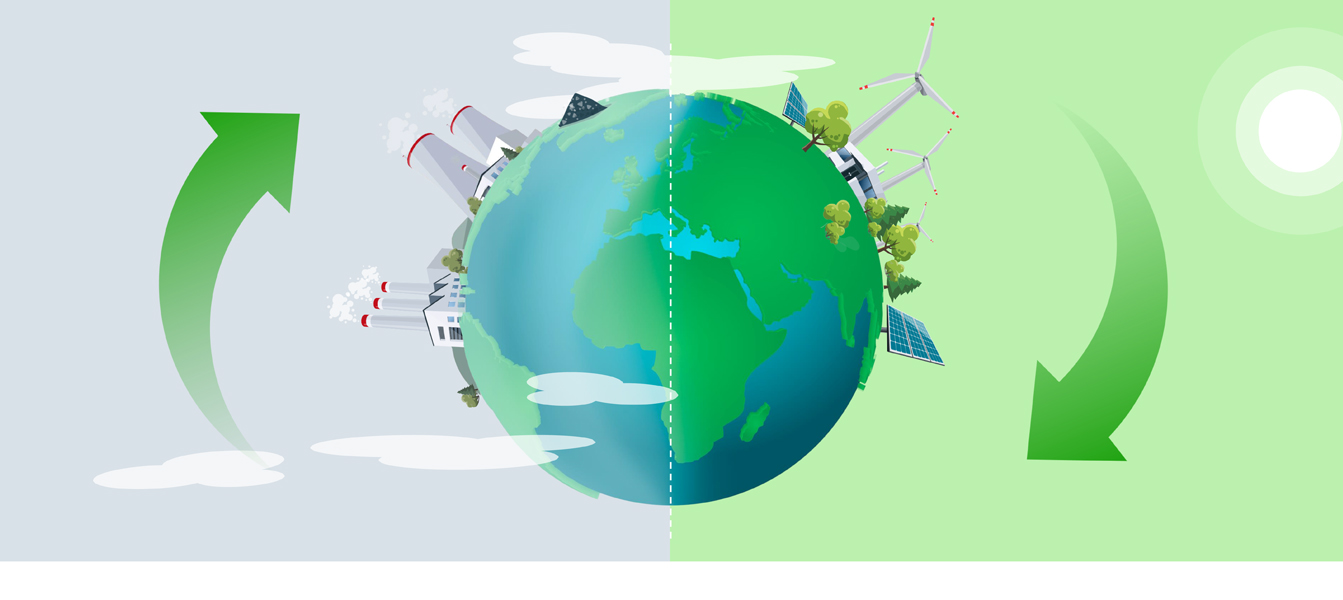

An integrated approach makes it possible to capture opportunities created by the evolving environment , and to build value stemming from socially fair energy transition of the Group. ESG aspects demonstrate a company’s position on managing societal and environmental impacts and on responsible corporate governance.

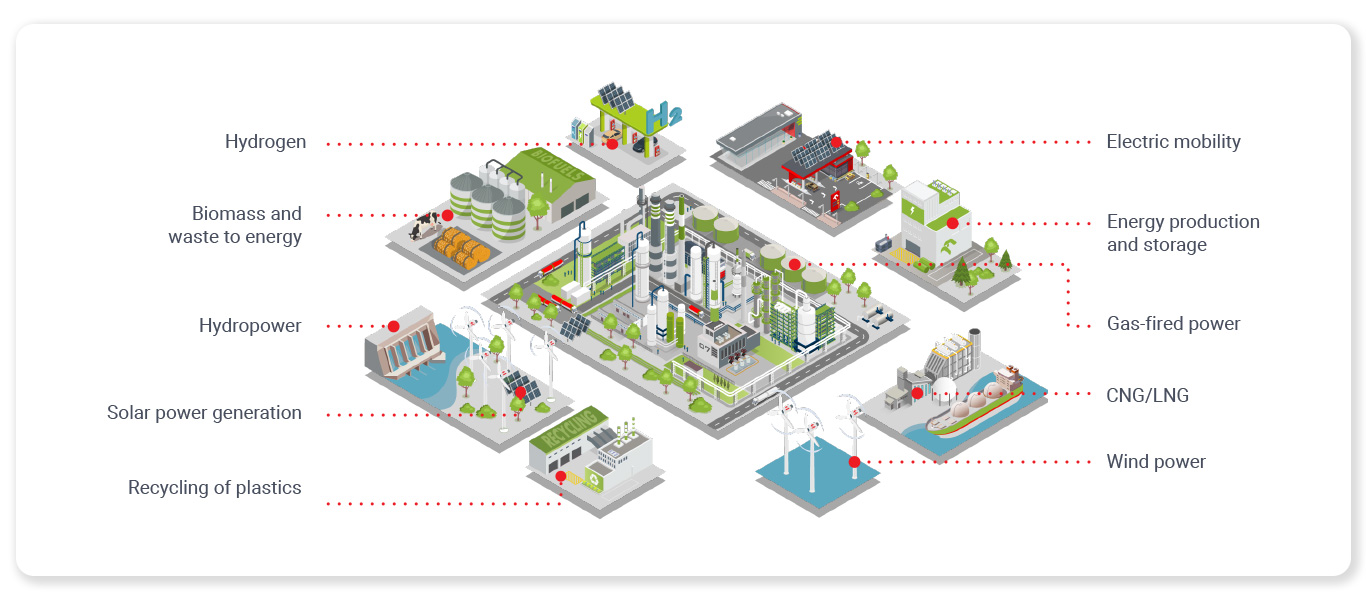

The new business strategy of the ORLEN Group is driven by sustainable development. Decarbonisation, development of renewables, biofuels and recycling, and sustainable and green bond issues pave the way to achieving carbon neutrality in line with the Paris Agreement scenarios. The ORLEN Group perceives ESG as strong foundations in the transformation of a multi-utility conglomerate.

ESG reporting shows the non-financial value of a company which aims to create added value rather than only maximise profits. For a forward-looking company, strategic ESG management is a guarantee of sustainable development, stable growth, and stakeholder confidence.

Information on our ESG performance is reported based on the Global Reporting Initiative (GRI) Standards and is externally assured. An interactive list of GRI indicators described in the ORLEN Group Integrated Report for 2020 is available in the ‘Our report’ section.

The scope of information contained in this Report takes into account the expectations resulting from international ESG ratings. PKN ORLEN also takes steps to consistently improve its compliance with the non-mandatory recommendations of the European Commission (EC Communication 2019/C 209/01) and of the Task Force on Climate-related Financial Disclosures (TCFD) regarding information on climate issues.

This document presents activities aimed at achieving the UN Sustainable Development Goals 2030.

In September 2020, PKN ORLEN announced a decarbonisation strategy, including specific commitments to reduce emissions and achieve climate neutrality. Sustainable development plays an important role in the process of building a multi-utility group and implementing the ambitious agenda under the ORLEN Group's Strategy until 2030, published in November 2020. The new business strategy is a response to the changes in our environment driven by the global climate crisis. It enhances resilience of our business models to climate change and its consequences across the value chain. Over the next decade, PKN ORLEN will allocate PLN 30bn to sustainability projects, including new business models.

A solid foundation for the ambitious agenda under the ORLEN Group’s 2030 Strategy and decarbonisation strategy are the sustainable development directions, as defined by PKN ORLEN in its Green Finance Framework, which the Company has committed to pursuing. Closely linked to the new business objectives, the Group’s sustainability management directions set ambitious ESG and CSR goals.

.png)

.png)