STRATEGIC OBJECTIVES UNTIL 2030

The ORLEN Group’s strategy until 2030 sets the course for the Group’s transformation into a multi-utility group and a leader of the energy transition in the region.

Our growth will be based on a diversified portfolio of existing and future operations, whose development is guided by the direction of the Group’s transformation until 2030.

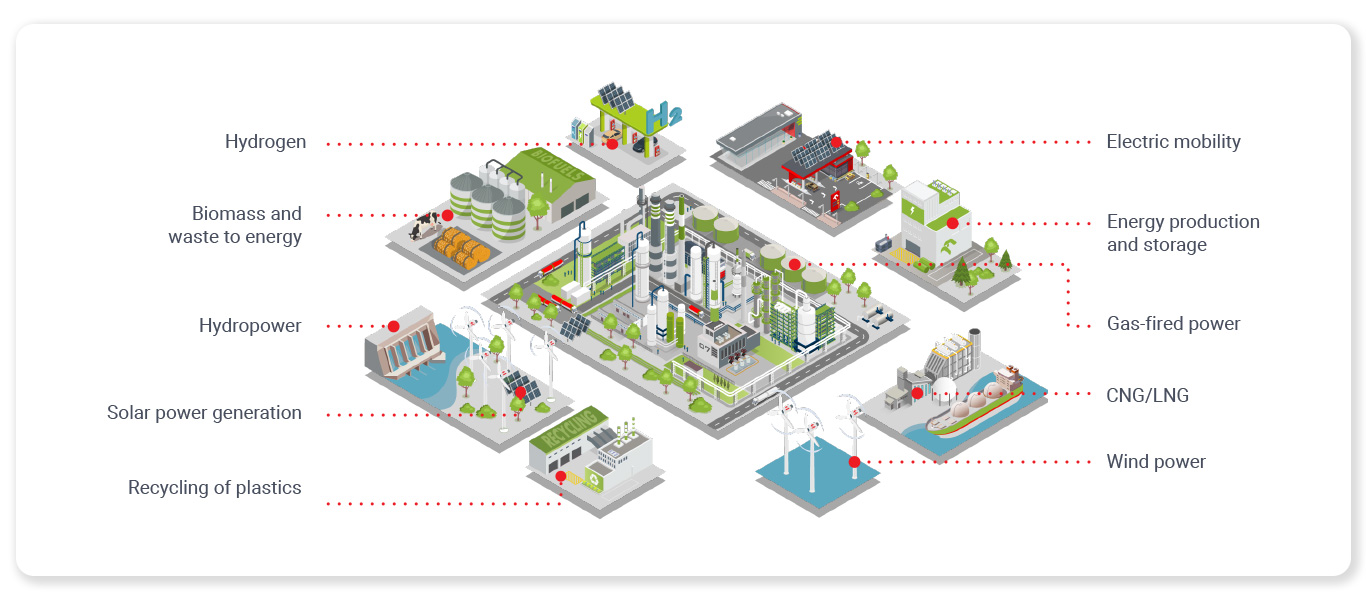

The path of the ORLEN Group’s transformation until 2030 has been charted around renewable energy and advanced petrochemicals. Business diversification efforts will be driven by maximised profits from our existing core business, to be transformed based on new technologies, in line with the emerging environmental and consumer trends. Delivery of the strategy will further diversify our revenue sources, in line with the long-term objective of net zero carbon emissions by 2050.

Everything we do at the ORLEN Group is underpinned by our values

The strategy also provides for resuming the progressive dividend policy, with the distribution levels at least on a par with the pre-pandemic values.

Our2030 aspirations

In response to technology trends and environmental challenges facing the energy sector, the ORLEN Group is set to become the leader of sustainable transition in Central Europe.

Strategic logic behindORLEN Group’s growth

By 2030, we plan to spend a total of PLN 140bn on investment projects. The Group’s growth is based on a diversified portfolio of investments in its existing and future business areas.

By following the ORLEN2030 strategy, the ORLEN Group is set to become the region’s leading multi-utility with a strong asset portfolio.